ASX tech stocks were red hot today. Pic: Getty Images

- ASX hovers at record high as tech surges

- Bitcoin hits $123k at the start of Crypto Week

- Hub24 jumps, Newmont CFO exits

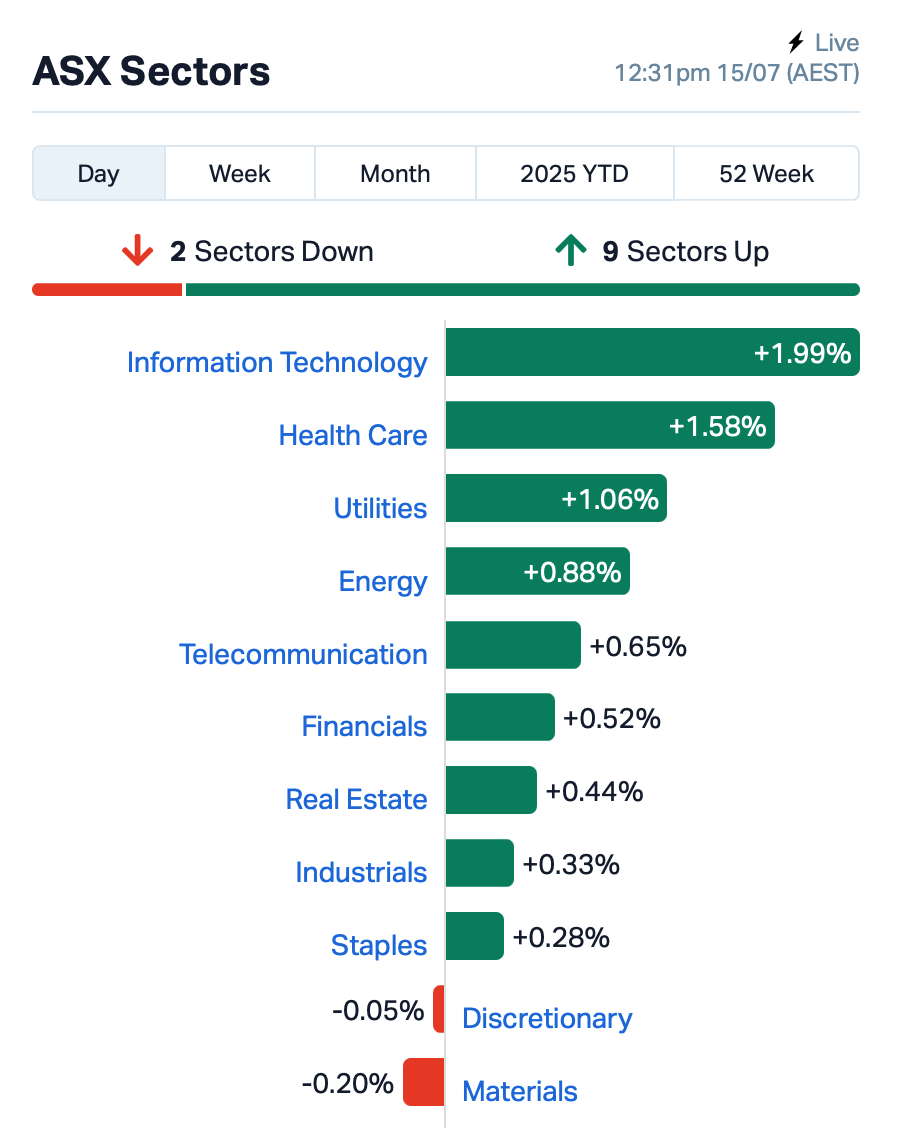

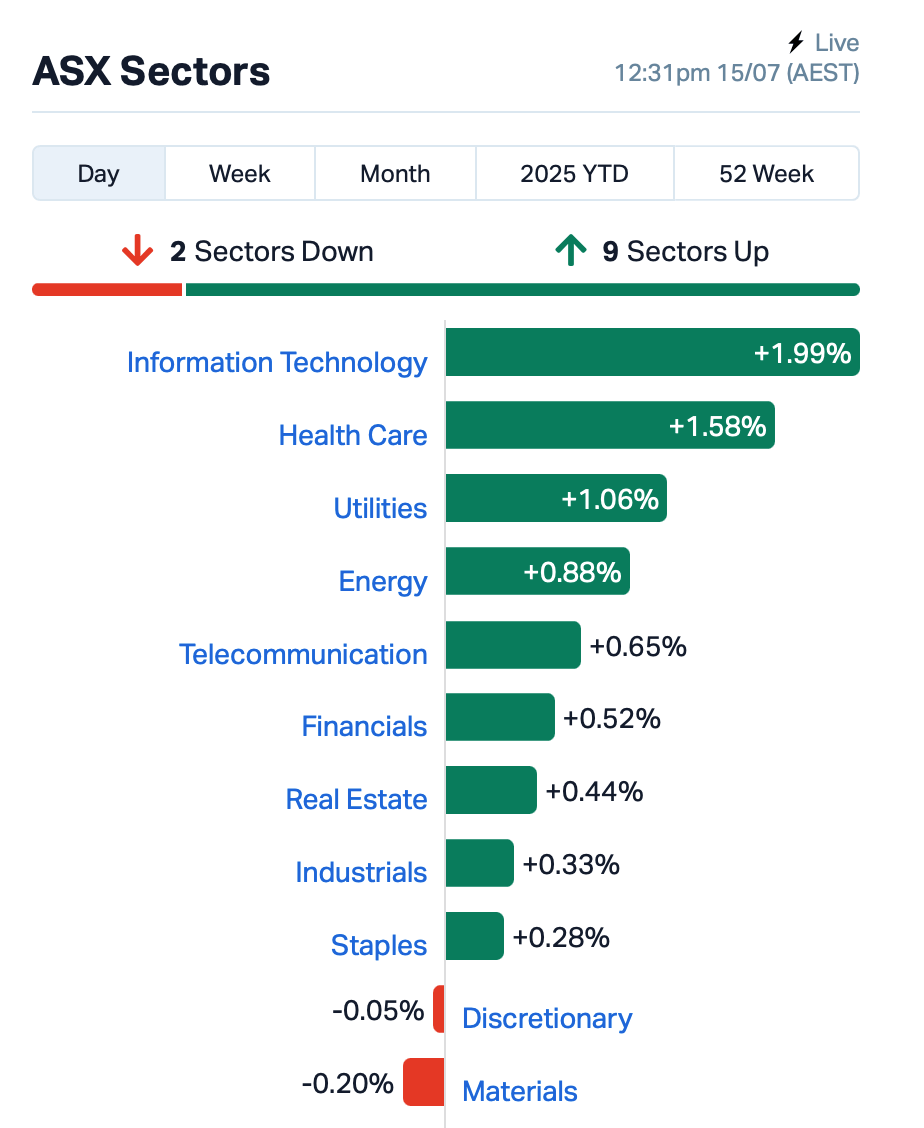

The ASX was up 0.4% by lunchtime in the east, and you could see traders glancing at the record books.

At this time of writing, the ASX 200 index is sitting pretty above the previous record close of 8603 set on July 4.

With tech stocks surging and Wall Street showing its poker face on Trump’s latest tariff gambits, local investors decided it was safe enough to hit the “buy” button again.

Last night, the Dow added 0.2%, the S&P edged up 0.1%, and the Nasdaq rose 0.3%, notching another record close.

Traders weren’t rattled despite Trump keeping markets guessing.

After slapping down a weekend threat of 30% tariffs on EU and Mexican imports (kicking in August 1 unless they all “negotiate better”), he backtracked just enough to keep things murky.

“Open to talk,” he said, then added, “The letters are the deals. The deals are made.” Clear as mud.

Over in crypto, Bitcoin briefly smashed through US$123,000 before pulling back to around US$119,450 at time of writing.

It’s up 70% since Trump won the election last November, thanks to the hope that Washington will finally give crypto the clarity it’s been begging for.

That moment might be close. This week is being dubbed “Crypto Week” in Congress, with three big bills on the table that could reshape the industry.

Stablecoin rules, anti-CBDC protections, and clearer regulatory guardrails are all up for debate.

Back to the ASX, where the tech sector was the clear standout this morning.

In the large caps space, wealth platform Hub24 (ASX:HUB) popped nearly 6% after reporting a 10% jump in funds under management during Q4 to $112.7 billion.

And, Newmont Corporation (ASX:NEM) announced its CFO, Karyn Ovelmen, had resigned effective immediately, replaced on an interim basis by chief legal officer Peter Wexler.

The company clarified there were no disagreements over accounting or disclosure. Newmont’s shares were up 0.5%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 15 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AKN | Auking Mining Ltd | 0.006 | 33% | 17,721,235 | $3,096,523 |

| IBX | Imagion Biosys Ltd | 0.018 | 29% | 19,700,679 | $2,818,780 |

| CP8 | Canphosphateltd | 0.075 | 25% | 187,589 | $18,405,632 |

| CUL | Cullen Resources | 0.005 | 25% | 250,040 | $2,773,607 |

| PPY | Papyrus Australia | 0.010 | 25% | 136,062 | $4,581,454 |

| SNS | Sensen Networks Ltd | 0.037 | 23% | 20,027 | $23,791,124 |

| ASN | Anson Resources Ltd | 0.088 | 22% | 7,825,276 | $99,845,031 |

| MHM | Mount Hope | 0.170 | 21% | 104,876 | $3,896,900 |

| JAN | Janison Edu Group | 0.180 | 20% | 317,618 | $38,983,238 |

| AYT | Austin Metals Ltd | 0.003 | 20% | 181,536 | $3,960,478 |

| BNL | Blue Star Helium Ltd | 0.006 | 20% | 129,748 | $13,474,426 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 6,000,083 | $16,884,455 |

| XPN | Xpon Technologies | 0.012 | 20% | 3,789,421 | $4,142,532 |

| PLN | Pioneer Lithium | 0.125 | 19% | 16,199 | $4,636,977 |

| MBK | Metal Bank Ltd | 0.013 | 18% | 472,025 | $5,472,049 |

| RON | Roninresourcesltd | 0.140 | 17% | 88,420 | $4,845,001 |

| AZL | Arizona Lithium Ltd | 0.007 | 17% | 2,750,517 | $31,621,887 |

| C7A | Clara Resources | 0.004 | 17% | 159,599 | $1,764,813 |

| ENV | Enova Mining Limited | 0.007 | 17% | 2,353,715 | $8,745,600 |

| KGD | Kula Gold Limited | 0.007 | 17% | 73,142 | $5,527,522 |

| BMM | Bayanminingandmin | 0.073 | 16% | 6,766,505 | $6,486,191 |

| ELS | Elsight Ltd | 1.870 | 16% | 1,252,517 | $293,512,056 |

| KNG | Kingsland Minerals | 0.110 | 16% | 61,350 | $6,893,287 |

| LM1 | Leeuwin Metals Ltd | 0.150 | 15% | 157,462 | $13,104,830 |

WordPress Table

Auking Mining (ASX:AKN) has kicked off exploration at its 100%-owned Myoff Creek rare earths and niobium project in British Columbia, Canada. It’s a well-positioned play in a known mineral-rich belt, with near-surface carbonatite mineralisation stretching 1.4km by 0.4km. The company is now flying a high-res helicopter survey across the 800-hectare tenure to map the potential size of the system.

Imagion Biosystems (ASX:IBX) is moving closer to kicking off its Phase 2 trial for the MagSense HER2 breast cancer imaging program in the US. It just wrapped a productive meeting with the FDA, where no red flags were raised, clearing the path to submit its IND application in Q3 2025. The trial will be led by top US surgical oncologist Dr William Dooley, who sees real potential in MagSense.

Mount Hope Mining (ASX:MHM) is set to kick off its maiden drill program in Q3 2025 at its 100%-owned Mt Hope Project in Cobar, NSW. It’s targeting three high-priority prospects – Mt Solitary, Black Hill, and Mt Hope East – with 3800 metres of drilling planned, including 1500 metres at Mt Solitary to convert the gold exploration target into a JORC-compliant resource.

Janison Education Group (ASX:JAN) has been picked by New Zealand’s Ministry of Education to deliver a new national digital assessment tool for students in Years 3 to 10. It’s starting with a $750k three-month contract to design the platform, which will assess reading, writing, maths, pānui, tuhituhi, and pāngarau twice a year, with full rollout set for Term 1, 2026.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for July 15 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AOA | Ausmon Resorces | 0.001 | -50% | 308,000 | $2,622,427 |

| SFG | Seafarms Group Ltd | 0.001 | -50% | 6,000 | $9,673,198 |

| EEL | Enrg Elements Ltd | 0.001 | -33% | 506,086 | $4,880,668 |

| SKN | Skin Elements Ltd | 0.002 | -33% | 55,557 | $3,225,642 |

| GTR | Gti Energy Ltd | 0.003 | -25% | 2,598,000 | $14,835,762 |

| RDS | Redstone Resources | 0.003 | -25% | 219,778 | $4,137,069 |

| APC | APC Minerals | 0.008 | -24% | 9,924,849 | $3,075,800 |

| BCB | Bowen Coal Limited | 0.077 | -23% | 1,616,377 | $10,775,756 |

| CC9 | Chariot Corporation | 0.054 | -23% | 206,947 | $8,354,764 |

| MGU | Magnum Mining & Exp | 0.007 | -22% | 500 | $20,862,334 |

| MEL | Metgasco Ltd | 0.002 | -20% | 47,619 | $4,581,467 |

| MRD | Mount Ridley Mines | 0.002 | -20% | 3,700 | $1,946,223 |

| RGL | Riversgold | 0.004 | -20% | 4,221,428 | $8,418,563 |

| SPQ | Superior Resources | 0.004 | -20% | 2,402,254 | $11,854,914 |

| RDG | Res Dev Group Ltd | 0.009 | -18% | 53,804 | $32,459,439 |

| OSX | Osteopore Limited | 0.014 | -18% | 5,996,555 | $3,111,733 |

| AQC | Auspaccoal Ltd | 0.015 | -17% | 3,397,751 | $12,608,417 |

| KM1 | Kalimetalslimited | 0.100 | -17% | 307,844 | $9,941,695 |

| TSL | Titanium Sands Ltd | 0.005 | -17% | 83,264 | $14,068,483 |

| KAL | Kalgoorliegoldmining | 0.039 | -15% | 5,593,224 | $17,558,619 |

| NVA | Nova Minerals Ltd | 0.255 | -15% | 1,196,332 | $96,899,225 |

| AIIDA | Almontyindustriesinc | 6.900 | -15% | 21,381 | $132,018,992 |

| LOC | Locatetechnologies | 0.150 | -14% | 332,056 | $40,976,995 |

| AJL | AJ Lucas Group | 0.006 | -14% | 156,934 | $9,630,107 |

| BLU | Blue Energy Limited | 0.006 | -14% | 20,000 | $12,956,815 |

WordPress Table

Tyro Payments (ASX:TYR) fell 6% after the Reserve Bank flagged a ban on surcharges across all major payment networks – eftpos, Mastercard, Visa – as part of a wider payments overhaul. That hits right at Tyro’s business model, and the market didn’t miss the message.

IN CASE YOU MISSED IT

Locksley Resources (ASX:LKY/OTCQB:LKYRF) has named US advisor Viriathus Capital LLC to support the company’s expansion into North American markets and help shape its downstream strategy.

Future Battery Minerals (ASX:FBM) has launched its first-ever RC drilling campaign at the Miriam project, targeting gold mineralisation at Forrest and the newly defined Canyon prospect.

Western Yilgarn (ASX:WYX) has beefed up its bauxite portfolio to 244Mt with a maiden resource estimate for the New Norcia deposit.

Argent Minerals (ASX:ARD) plans to generate material for metallurgical test work with two deep diamond drillholes at the Kempfield project ahead of full-scale development.

Imagion Biosystems (ASX:IBX) is on track to start Phase II clinical trial for HER2 breast cancer after a positive meeting with the US FDA. The company plans to fast-track manufacturing of the MagSense HER2 imaging agent for the trial.

LAST ORDERS

Star Minerals (ASX:SMS) is poised to wrap up environmental studies for its Tumblegum South gold project after submitting a native vegetation clearing permit application with the WA Department of Mines, Petroleum and Exploration.

The company reckons its impact on the area will be minimal, as much of it has already been largely cleared of flora.

At Stockhead, we tell it like it is. While Star Minerals and Imagion Biosystems are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.