Last week, James Cooper wrote about the need to be on high alert for a copper breakout. This week, copper is breaking out… James lays out the game plan from here.

This week’s big event in commodity markets has been copper’s fierce breakout into new all-time highs.

That’s caught a lot of investors and traders off guard.

But if you’ve been following Mining Memo, you’ll know this event was primed to happen… Imminently.

This is what I wrote in last week’s Mining Memo ahead of the 10% move in copper futures on Tuesday:

***

…gold is the ONLY commodity that has broken into new all-time highs in this cycle.

Yes, we’ve had price spikes in things like uranium, silver, platinum and rare earths.

But what matters here is the historical breakout event, exclusively limited to gold.

Gold has now pushed well past its major resistance set in 2011, the peak of the last commodity cycle.

So, why does that matter?

If you believe and understand my theory, you’ll know that gold leads these big commodity-cycle events, with other metals following higher, eventually.

And importantly, gold confirmed this signal in 2024.

We’re now one year on from that milestone event.

So that means we should be seeing other commodities starting to press higher and threaten ‘their own’ all-time highs.

And that’s precisely what’s happening!

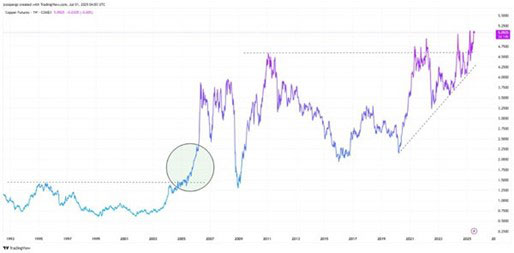

Copper: on the precipice of a historical breakout

Remarkably, copper is again just a smidgen away from becoming the next major commodity to break past its all-time high from 2011

|

|

|

Source: Trading View |

First gold, now copper.

The last time copper did this was EXACTLY 20 years ago, back in 2005.

I’ve circled that event on the chart above.

But another interesting aspect here is that these key resistance levels have the potential to unleash powerful price moves in commodity markets.

Copper surged 140% in less than 18 months when it last broke its multi-year resistance level in 2005.

I doubt anyone considers this remotely possible for today’s copper market.

But that’s what these powerful ‘technical’ levels can unleash.

In 2005, the copper ‘breakout’ generated a surge of excitement across the resource market, especially among junior mining stocks.

It was the crystallising event that kick-started that last commodity cycle.

And the catalyst that finally drove speculation back into junior mining stocks.

Advertisement:

WATCH NOW: Australia’s ‘abandoned gold’

A revolution is taking place in Australia’s mining sector.

A new type of miner is bringing old gold and critical minerals back to life…and already sending some stocks soaring.

Our in-house mining expert — a former industry geologist — has tapped his industry contacts to uncover four of these stocks that could be next…

Click here to watch now.

And that’s what I’ve been preparing my paid readership group for this year: a potential repeat of what occurred in 2005.

***

And with Trump’s 50% tariff announcement on copper imports, futures finally did what I’ve been anticipating for quite some time…

They ripped into new all-time highs!

This week’s massive 10% move in the futures market sent copper prices on the New York COMEX into a technical breakout:

|

|

|

Source: Tradingeconomics.com |

Becoming only the second metal in this cycle (after gold) to push firmly past its historic top from 2011.

As I stated last week, this is the set-up I’ve been preparing my paid readership group for.

Across my two services, we have around eleven stocks directly leveraged to copper.

From large producers down to the early grassroots explorers.

So, it’s fair to say we have a lot at stake here!

If Tuesday’s breakout continues, we’re locked, loaded, and ready to profit!

Why copper can go a lot higher from here

As I detailed, the last time copper broke multi-year resistance was in 2005.

After that, prices went parabolic, up around 140% in 18 months.

Junior mining stocks followed with heavy triple-digit gains.

It’s now a matter of watching and waiting to see how resource stocks follow copper’s bullish move.

Technical breakouts of this magnitude can unleash serious speculation into the junior mining market. I’ll give you examples of that next week.

2005 offers the best blueprint for what COULD happen next.

A similar multi-year technical break-out looks to be unfolding.

You must be alert to the risks, but equally prepared to take full advantage… One way you can do that is by joining me here, at Diggers & Drillers.

On Wednesday, we just issued a brand new recommendation for a copper producer.

It owns one of the world’s largest high-grade copper deposits and boasts one of the best operating margins in the business.

Yet, until recently, this company’s share price was almost 50% off last year’s highs! And it’s only just starting to recover.

This is an opportunity to capture deep value in a market primed for speculation!

You can access all the details here.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

All advice is general advice and has not taken into account your personal circumstances.

Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.