TEMPLATES

Things you need to know before...

Are you thinking of closing your personal loan account? Or is it better if you leave it as it is and wait for its tenor to be over? It’s natural that all of us want to have a debt-free life without worrying much about the payment obligations such as EMIs, you know! The sooner you

Unlocking the value of generative AI...

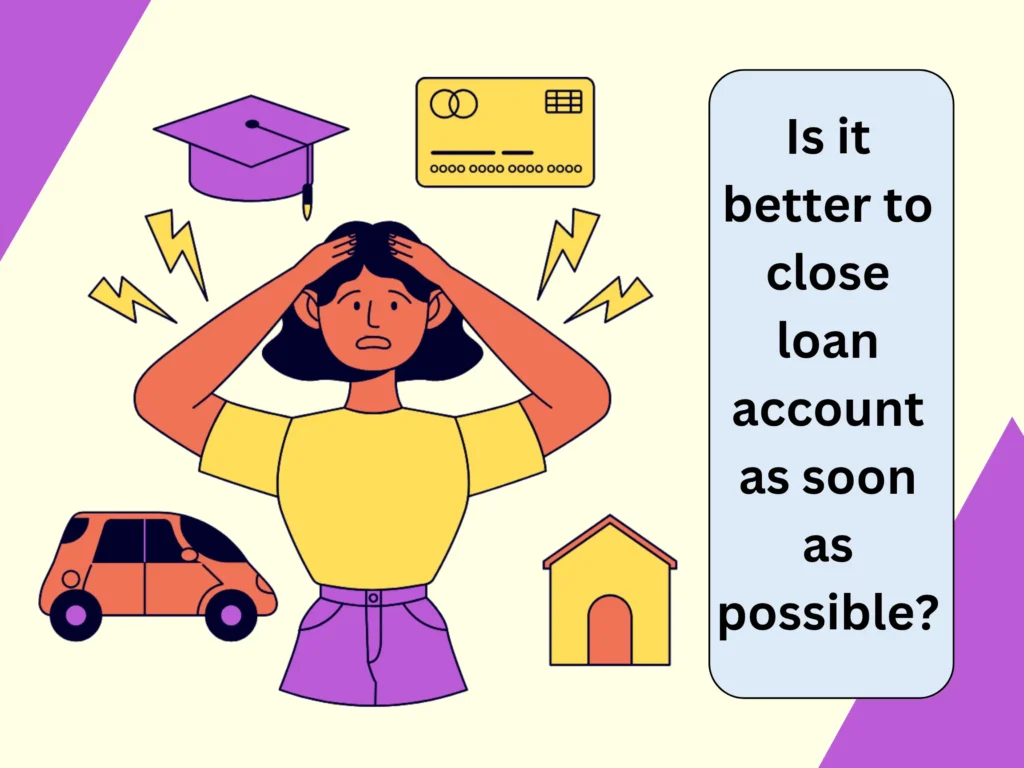

The use of AI in the payments industry is not a new phenomenon. In fact, Accenture’s recent Payments Technology Reinvention Study shows that leading banks are already investing significantly in AI and generative AI and have managed to automate 40% of manual tasks in their payments business. Advancements in speech recognition, image generation and machine

Having navigated HDFC merger, HDFC Bank...

Sashidhar Jagdishan, MD & CEO, HDFC Bank | Photo Credit: HDFC Bank, after successfully navigating the merger with erstwhile HDFC, is now positioned for faster growth in the current financial year, MD & CEO Sashidhar Jagdishan told stakeholders in the bank’s FY25 annual report. The bank had to pull the brakes on loan growth in

BBVA launches crypto trading for Spain...

Angel Navarrete/Bloomberg As cryptocurrencies become increasingly mainstream in financial services, banks are thinking about taking advantage of this trend and offering in-house crypto custody services to their customers. BBVA recently introduced crypto services to its retail customers in Spain so individuals could directly buy, sell, and hold bitcoin and ether through the bank’s mobile app.

April is Financial Literacy Month:

April is Financial Literacy Month: – Union Bank Union Bank Home » The Go Far Blog from Union Bank » April is Financial Literacy Month: A Beginner’s Guide to Investment April 17, 2025 April is Financial Literacy Month, a great reminder to focus on improving your understanding of personal finance. At Union Bank, we believe

strategic foresight in central banks –...

Julia Giese and Jacqueline Koay We live in an era of rapid change, complexity and uncertainty. Over recent years, severe global shocks have been frequent, with profound implications for our economy and financial system. Yet such shocks are impossible to forecast with any precision as they are not extrapolations of past relationships. Our economy and

Stablecoin Act brings Crypto closer to...

I have not been a supporter of Stablecoin due to lack of safety and regulatory provisions in the same vein as regulated Banks. The Genius (really ??) Act changes that and provides for regulatory provisions similar ~ to that which governs other financial entities, including maintenance of capital requirements and money laundering protection. The AML

Dieterich Bank Online & Mobile Banking...

When you’re looking to manage your finances more conveniently and securely from wherever you are, you’ll want to set up online and mobile banking. If you’ve never worked with digital banking before or if you have questions about certain features of your online accounts, we’ve got you covered. Here’s our comprehensive guide to Dieterich

Social engineering and the banking

Social Engineering is a term used to describe the process of manipulating people into giving up their personal information. It could be stealing someone’s identity, data related to financial matters, or other online scams and cybercrimes. It’s often done by pretending to be someone else or using social media to gain access to sensitive data.

Guardians of Trust: Navigating Cybersecurity in...

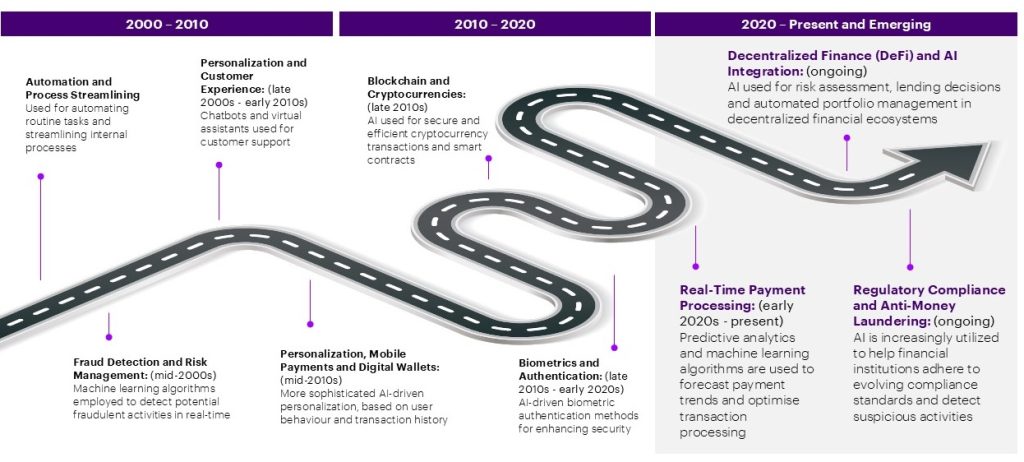

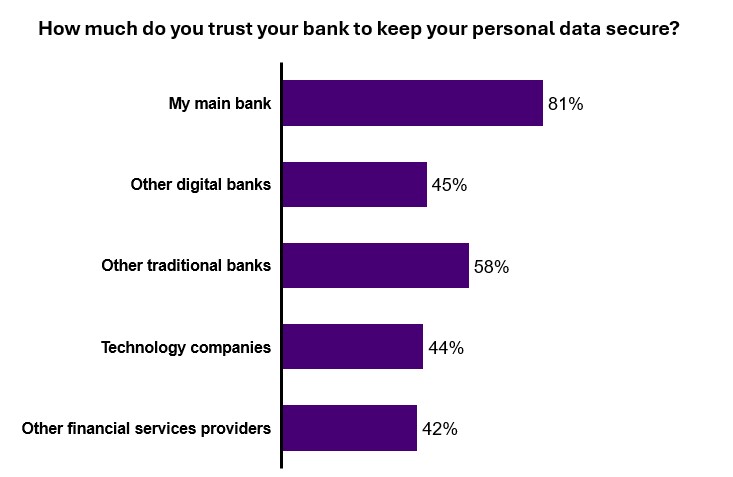

Despite significant investments in cybersecurity, customers lack trust in the banking system’s ability to protect their data. “Trust is the bedrock of business. It transforms transactions into relationships and clients into loyal advocates.” According to Accenture’s recent Banking Consumer Study surveying 49,000 respondents across 39 countries, 58% of banking customers are concerned about the security