TEMPLATES

Financial Checkup Guide: Close the Year...

Union Bank December 13, 2024 The new year isn’t just made for celebrations, it’s a time to take a look at your finances and see where you stand. We don’t just mean a quick glance at your savings and checking accounts, a financial review means assessing your financial progress and setting goals for the new

unveiling the risk of delivery failures...

Miruna-Daniela Ivan The widespread practice of financial institution to re-use securities received as collateral plays a key role in the repurchase agreement (repo) market functioning. By increasing the availability of securities which can be used as collateral, collateral re-use lowers funding costs under normal market conditions, allowing collateral to flow to where it is most

content

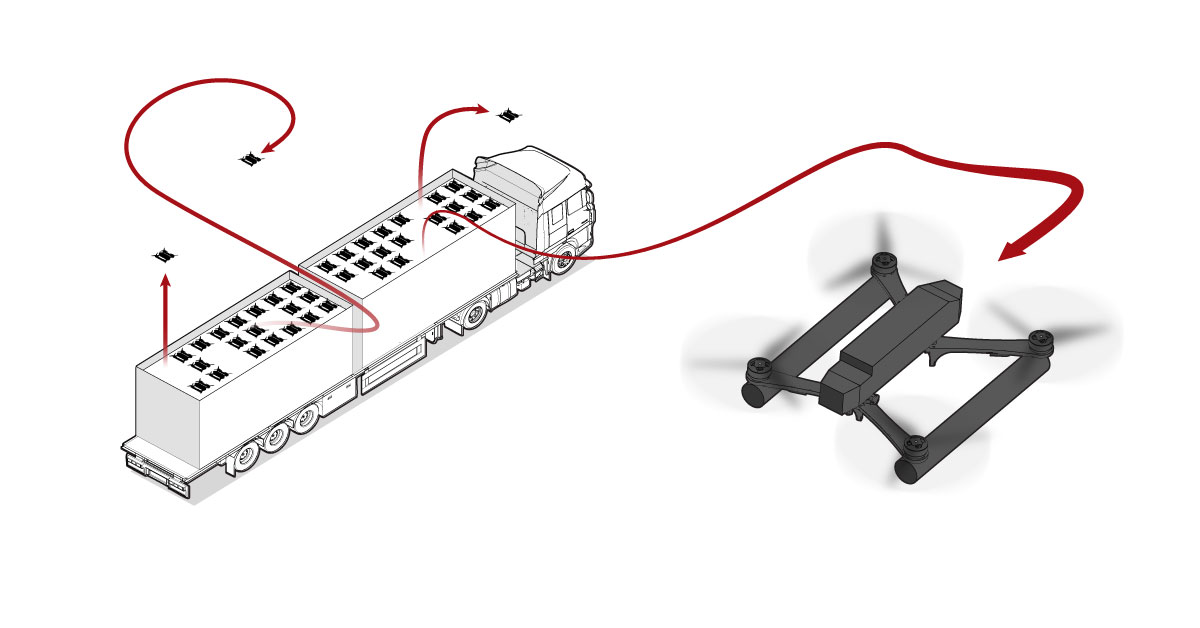

How Ukraine pulled off an audacious attack deep inside Russia Months of planning went into a covert operation that relied on cheap, short-range drones By Mike Collett-White, Prasanta Kumar Duttaand Mariano Zafra Published June 4, 2024 11:00 AM EDT Three days after Ukraine launched its most complex attack against Russia since the full-scale war began, details of how it was

Easy Ways to Save Money

Summary aving money doesn’t have to be overwhelming—monthly saving challenges can make it fun and manageable. This blog explores creative ways to boost your savings, including: No-Spend Month – Cut out non-essential expenses for 30 days. 52-Week Challenge – Start with $1 in Week 1, adding a dollar each week until you reach $1,378.Spare Change

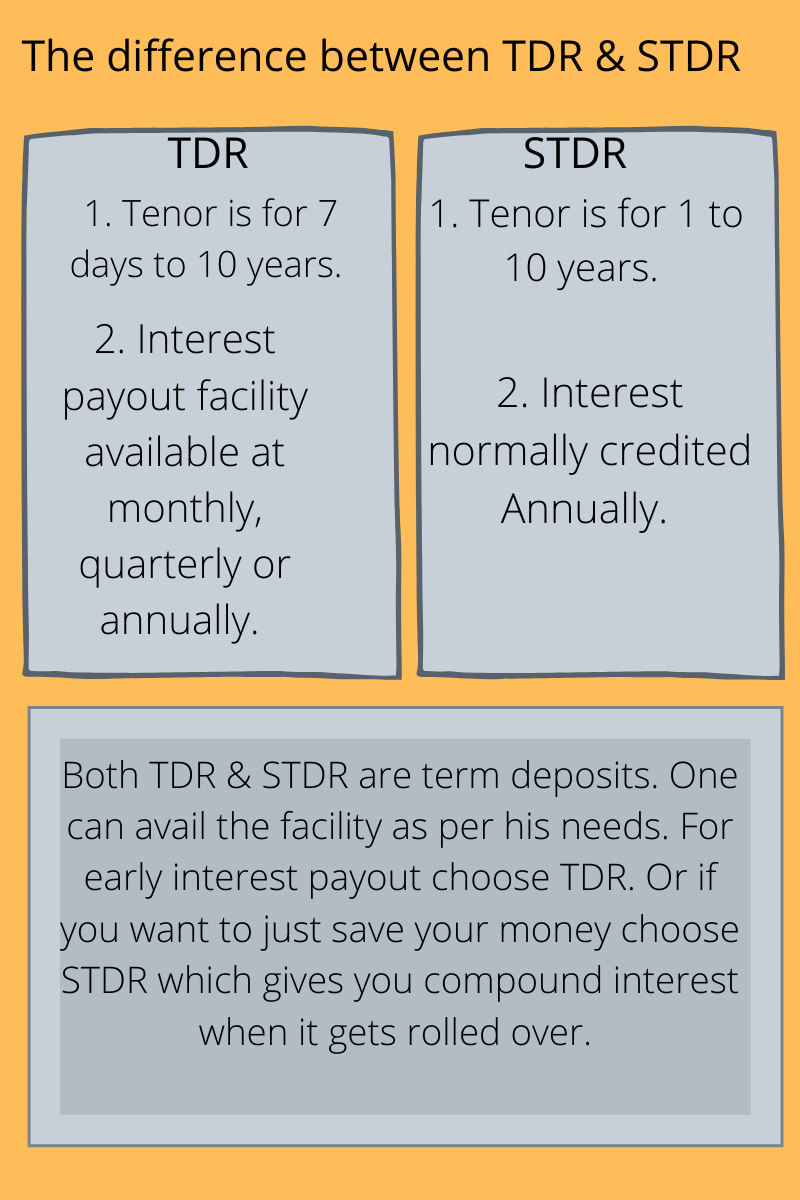

Fixed deposits TDR and STDR, how...

Fixed deposits, a time deposits you can get in any bank. There are two types of fixed deposits, one is TDR and the other is STDR. Literally speaking, both are term deposits but there are certain aspects where one differs from the other. It helps in choosing the right product as per investors’ needs. We

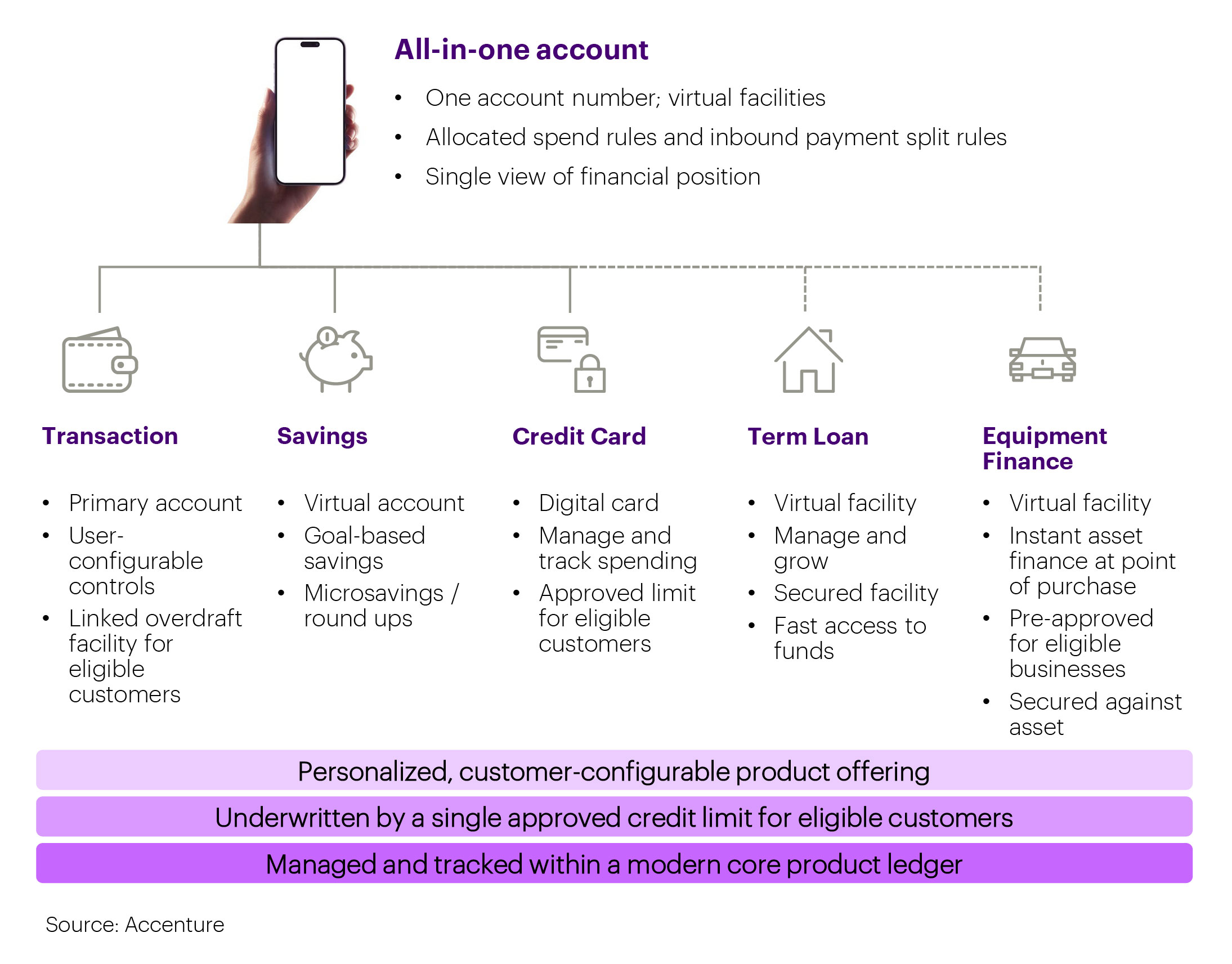

Reinvent lending offerings and business models...

In our discussions with banking executives, a common theme is how the lending market is changing and constantly giving rise to threats and opportunities, as covered in our Commercial Banking Top Trends for 2024. Confronting these changes is essential, but it also requires banks to be willing to reinvent to stay ahead. Previously, we touched

Bitcoin pulls back as record rally...

The cryptocurrency declined as much 3.2%, the most in more than three weeks, and was trading at $117,386 at 12:40 pm | Photo Credit: REMO CASILLI Bitcoin fell as traders cashed in after a record-breaking rally sent the top digital token above the $120,000 milestone. The cryptocurrency declined as much 3.2%, the most in more

OCC rolls back disparate impact oversight

The Office of the Comptroller of the Currency is rolling back disparate impact supervision for banks, it announced Monday. As such, the federal agency’s supervisory process for fair lending compliance will no longer include the examination for cases in which neutral policies have an unequal effect on a protected class such as by race or

Welcome to Union Bank’s North Conway...

Meet our North Conway team, a group of local experts dedicated to understanding the banking needs of the Greater Mount Washington Valley region. – Susan Perry, Senior Vice President, Commercial Loan Officer – Will Perez-Moya, Branch Manager – Kathy Sanderson, Sr. Residential Mortgage Loan Originator (NMLS 409084) – Thomas Rubino, Universal Banker 1 We asked our

More mortgage lending might push home...

Jamie Waddell and Danny Walker Would expanding mortgage supply lead to increased home ownership? Given that 90% of young home owners have a mortgage, it’s tempting to assume the answer is yes. But our analysis suggests that assumption is not necessarily true. We show that increases in mortgage supply have historically had no discernible effect