PRESENT

Director deals: Iomart restructuring provides reason...

Cloud computing and hosting services provider Iomart (LON: IOM) has been struggling in recent years as profit and the share price have declined. Iomart chair Richard Last has bought an initial 50,000 shares at 77.27p each, which is not much above the low for the year. Richard Last joined the board last June. The

Anglo American to sell nickel business...

Anglo American is ramping up efforts to streamline its business amid takeover pressure from BHP with the sale of its nickel business. Mining giant Anglo American has struck a deal to sell its Brazilian nickel business to Asian metals group MMG Limited in a transaction worth up to $500 million. The sale, announced today, will

See what £10k invested in ailing...

Image source: Getty Images GSK (LSE: GSK) shares have been a massive disappointment since I added them to my Self-Invested Personal Pension in March and June last year. So far, I’m down around 15% and can’t see much sign of a recovery. The shares are down 6.5% over the last 12 months and more than 12%

US Stock Market Faces Turbulence and...

The US stock market took another hit on Friday and managed to finish a disastrous week in the red as poor economic news coupled with weak earnings from some major tech players continued an alarming five-day collapse. The decline was itself heightened by recently-released non-farm payroll figures that showed a modest 114,000 jobs added to

AIM weekly movers: Inspiration returns

A contract win helped the Inspiration Healthcare (LON: IHC) share price rebound 44.4% to 19.5p. A $6m contract has been won by the Neonatal division and the core business is doing well. However, there are further delays to the Middle East contract – the first shipment is awaiting custom clearance – and revenues in the

Gold and Copper Markets Respond to...

On Friday gold jumped over 1% to unprecedented highs after the dollar and Treasury yields fell. The movements followed remarks from Federal Reserve Chair Jerome Powell that suggested an interest rate reduction in September. Concerns about inflation near the Fed’s 2% goal added to signs of lower interest rates, as Powell’s comments did. For a

AIM weekly movers: Savannah Energy returns...

Metals One (LON: MET1) is proposing a capital reorganisation that will involve a ten-for-one share consolidation and reduction in the nominal value to 0.01p so that new shares can be issued. This is expected to be completed on 26 March. Metals One is involved in the Black Schist nickel copper cobalt zinc project in Finland

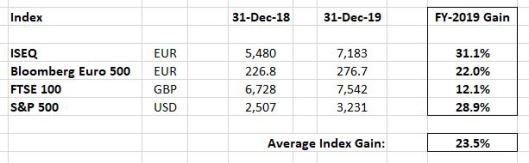

FY-2019…Hella Surprise Of A Year!?

It’s still January…so by now, I’m sweating to wrap this up by month-end (at the very latest!), while you’re probably feeling besieged (& bamboozled) by the media’s parade of talking heads who seamlessly re-write their broken #2019 narratives & still pitch their #2020 market prognostications with undaunted confidence. Which is a tad discouraging when I’m

Larry Fink cautions on budget deficit...

BlackRock CEO Larry Fink has joined the long and growing list of prominent people who have cautioned on the high US budget deficit and the alarming rise in the country’s national debt. His comments come at a time when President Donald Trump is pushing for his tax bill despite opposition from several quarters. Pointing to

Could Ferrexpo be a potential dividend...

You can read or watch my full review of Ferrexpo over on my new website: https://www.ukdividendstocks.com/blog/is-ferrexpo-a-good-dividend-investment You can also listen to the review on the UK Dividend Stocks Podcast: UK Dividend Stocks Podcast Episode 5: Ferrexpo Like this: Like Loading… Related Posts Author: John Kingham I cover both the theory and practice of investing in