Public sector bank employees attrition rate continued to be in lower-single digit

Large sized private banks have reported a meaningful fall in their employee attrition/turnover rate in FY25 as against FY24, as lenders focused on conducting more employee engagement, wellness programs, and incentivised better performers.

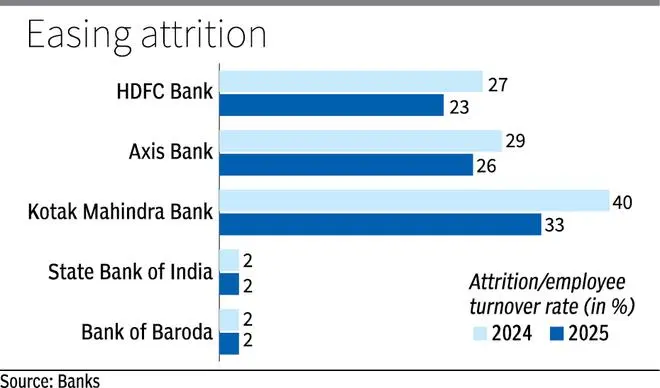

Country’s largest private lender HDFC Bank’s annual attrition rate fell to 23 per cent in FY25 from 27 per cent last fiscal, Axis Bank’s employee turnover rate stood at 26 per cent in FY25 versus 29 per cent in FY24 and Kotak Mahindra Bank’s turnover rate fell to 33 per cent from 40 per cent in FY24. Public sector bank employees attrition rate continued to be in lower-single digit. Junior to mid-level employees with less than 30 years of age continued to dominate attrition trends in comparison with senior level employees.

“Sustaining our growth while maintaining a nearly flat headcount is a testament to the efficiency and dedication of our teams. Furthermore, the significant reduction in attrition from 26.9 per cent in FY24 to 22.6 per cent in FY25 underscores the positive strides we are making in fostering an enabling work environment,” said Sashidhar Jagdishan, MD & CEO, HDFC Bank.

“…Our investment in building culture capability has impacted over 27,000 managers, equipping them further to lead with empathy, agility, and innovation…Our capability building strategy is clear: Build future ready leaders and future-proof skills. In FY25, we took significant strides in leadership-development, achieving a remarkable 500 per cent increase in coverage,” he said. The lender is working towards improving employee skills in generative AI, while providing employees mindfulness, stress management and confidential counselling services.

Retention rate

In order to improve the retention rate of employees, Axis Bank is engaging with employees via periodic newsletters, management visit to branches, employee engagement surveys, town-hall meetings with the bank chief, among others.

“This year, we launched a number of initiatives including ‘Best of Kotak for Kotakites’ and transparent career growth plans for branch managers. We also continued to invest in our young talent through initiatives like Kotak Young Leaders programme. At senior management levels, we have introduced both financial and non-financial measures to focus the organisation on customer centricity and collaboration,” said Ashok Vaswani, MD at Kotak Mahindra Bank.

Published on July 14, 2025