Goodness me.

Back on May 26, I wrote the following to my Small Cap Systems subscribers…

“If you’re looking to trade, our existing position in Electro Optic Systems (EOS) is looking ripe for further appreciation…

“EOS is a defence contractor that’s pivoting to specialise in the counter drone market.

“One of the biggest themes in the market right now is the global escalation in military spending and geopolitical tension.

“This suggests that EOS could enjoy double digit, compound growth in revenue over the next 5 years, at least.

“Two other shares in this space, Austal (ASB) and DroneShield (DRO) are up for the year too.

“EOS traded in a sideways range for the first three months of the year. It’s now broken out of it.”

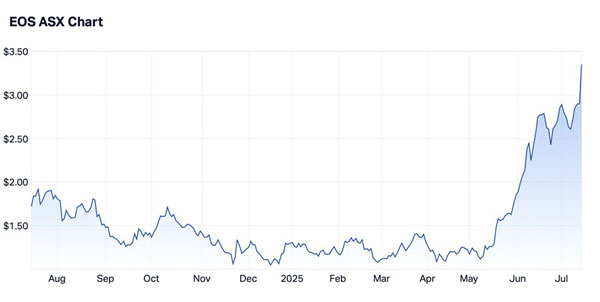

EOS is now up 100% since that trade went out. Look at the chart…

|

|

|

Source: Market Index |

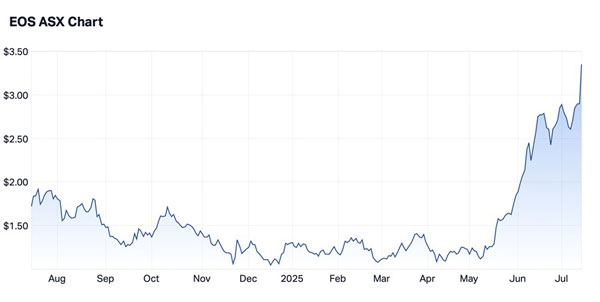

And look at $DRO this year (Small Cap Systems isn’t on this one)…

|

|

|

Source: Market Index |

These are the moves that bring investors, traders and punters to the small cap sector.

It’s this kind of price action that could bring a whole lot more. Fast money sells like nothing else.

Also consider this report from the Australian Financial Review today…

“Boutique manager Paragon has topped Morningstar’s list of Australia’s best stock-pickers for the 2024-2025 financial year, after its hedge fund achieved the rare feat of doubling investors’ money.”

That is an epic return. Well done John.

Oddly enough, I was sitting across the table from Paragon’s John Deniz the other week.

Little did I know he was on his way to being the king stock picker for the year.

How did he double his fund capital? Mining shares!

All of the above – (unprofitable) small caps like EOS and DRO, mining juniors – are for the high risk investor.

This is not for Aunt Joan’s retirement fund, or your spare mortgage payment.

But the above examples do show what you can achieve if you’re prepared to put some capital into higher risk opportunities.

One of those, for me, back in 2023, was bitcoin.

It was around A$35 thousand per BTC back then.

It’s getting mighty close to A$200,000 now. That’s turbocharged the returns of my SMSF in recent years.

The bitcoin bull run again seeds the idea that there’s money to be made in financial markets. This should draw in more money as people chase returns.

A lot of people gripe that the Aussie market is up at highs even though earnings are flat and the world seems a bit of a dog’s breakfast currently.

But you have to dance when and where it’s raining too.

That said…

Right now, Aussie investors – including you, me and anyone else – face the same problem.

The ASX/200 is up and about, but without showing much earnings growth for three years. The Chanticleer column calls it a “profit drought”.

Worse, 11 companies account for 50% of the index. If they’re not pumping, it’s hard to see the index really ripping.

That puts the burden on investors to come up with some alternative strategies.

It could be anything – American shares, gold, bitcoin, small caps, thematic ETFs – whatever suits your style.

But one thing is not negotiable. You’ll need to be active.

This is a dirty word to some. They like to sell the line that passive investing is the holy grail of funds management.

And for some, it is. But not to me, and, if you’re reading this, probably not for you either.

There are plenty of investment strategies that beat the ASX/200 return last year. No doubt some will do so again this year.

But what worked in the last 12 months probably won’t work the same way, or to the same extent, in the next 12.

That’s why the financial markets are like the gym. You have to turn up every day, and do everything you can, with no end in sight, ever.

Often, something you see or read won’t become relevant for months, sometimes years.

If you’re going to be an active investor, don’t forget it’s a lifelong pursuit.

Arnold Schwarzenegger still goes to the gym at 77. He’s been working out for over 60 years. Warren Buffett just resigned as CEO of Berkshire Hathaway at 94.

The question you need to know from the get go: do you love it that much to do that?

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

|

|

|

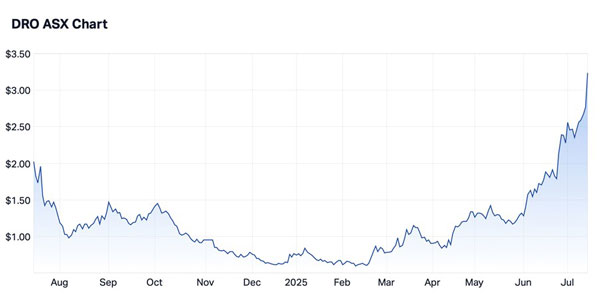

Source: Tradingview |

With Japanese approaching upper house elections on 20 July, bond market traders are selling first and asking questions later.

The Japanese 30-year bond yield jumped 43bps (nearly half a percent) in just the last two weeks to 3.18%.

You can see in the chart above that 30-year bonds had a yield of 0% in 2016 which is completely bonkers.

In the last couple of years the Bank of Japan has stepped back from their control of the yield on long bonds but have kept interest rates incredibly low, stoking inflation.

We are seeing a steepening of the yield curve worldwide as investors demand higher returns to take on the risk of holding bonds for many years.

When interest rates were near zero, yield chasing investors piled into long-term bonds. Yield curves became very flat which meant investors were receiving ridiculously low yields for taking on the risk of inflation in future decades (30-year yields at 0% for example).

That distortion in markets is now reversing and it appears Japanese bonds are yet to find the right level.

How high will rates go and at what point will stock markets take fright?

Big spending governments are on notice that they can’t continue to borrow and spend without any consequences. Perhaps we are still in the early stages of the Japanese bond market sell-off and the next stage involves a crash..

Regards,

|

Murray Dawes,

Editor, Retirement Trader