July 1, 2025

On May 22 the House passed the tax reform and spending cuts legislation, with the working title of “One Big Beautiful Bill Act.” This will be major legislation, and spirited Senate debate can be expected. The key estate planning news is that the bill would

boost the federal estate and gift tax exemption permanently to $15 million, with future inflation adjustments. Although some had advocated for outright repeal of the federal estate tax, other commentators observed that the permanently enlarged exemption will create greater stability and certainty in estate planning, as it won’t upend the assumptions underlying existing estate plans.

Other important changes include:

• The expiring provisions of the Tax Cuts and Act of 2017 will not expire at year-end, which heads off a scheduled tax increase for 62% of taxpayers. This includes the wider tax brackets, the increased standard deduction, the increased exemption for the alternative minimum tax (AMT), and the elimination of the personal exemption.

• Repeal some of the tax subsidies for “green” energy, as enacted in the Inflation Reduction Act.

• For tax years from 2025 through 2028, tip income would be deductible for some individuals; the premium portion of overtime pay would be deductible for some taxpayers; interest on auto loans for autos with final assembly in the U.S. would be deductible; and most seniors would get an enlarged standard deduction. The enlarged deduction for seniors is apparently in lieu of making Social Security benefits totally tax free, and it phases out for higher-income seniors.

• There will be higher taxes on endowments and private foundations.

Revenue effects

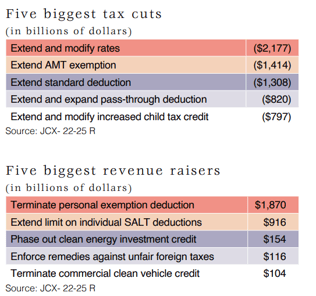

The Joint Committee on Taxation revenue estimates [JCX- 22-25 R] show that the largest ten-year impacts would come from the extension of current tax rates ($2.17

trillion), the current AMT rules ($1.41 trillion) and the enlarged standard deduction ($1.30 trillion). These are offset by a revenue gain of $1.86 trillion from the permanent repeal of personal exemptions. Extending the SALT deduction with a higher cap will increase projected revenue by $915 billion.

The permanent $15 million estate and gift tax exemption is projected to reduce revenue by $211 billion over ten years. The four items requested by President Trump (such as no taxes on tips or overtime) combined would

reduce revenue by $293 billion, because they expire after four years.

A Tax Foundation study of the proposed legislation found that projected federal tax revenue would fall by $4.1 trillion over the ten-year budget window. The tax changes would boost the economy by 0.6%. With a dynamic analysis that takes the economic effects of taxes into account, the revenue shortfall is reduced to $3.3 trillion. The tables below show the top five tax cuts and the top five revenue raisers, according to the Joint Committee analysis.

« Back to Articles