Betashares Australian Quality ETF (ASX: AQLT) had another strong financial year outperforming the benchmark S&P/ASX 200 by 6.2%, improving the funds average since inception outperformance to 4.2% p.a., AQLT’s inception date was 4 April 2022.

Like we did last year, we wanted to take the opportunity to analyse AQLT’s performance as the financial year lines up closely with AQLT’s annual rebalance.

As a refresher, AQLT holds the largest companies listed on the ASX, but weighted by quality metrics rather than market capitalisation, meaning you get higher exposure to names like Wesfarmers and Macquarie Group and lower exposure to BHP and CBA, and high-quality names from the mid and small caps, including Pro Medicus, Hub 24 and Breville.

Firstly, a reminder that past performance is not indicative of future performance.

Skewed to the upside

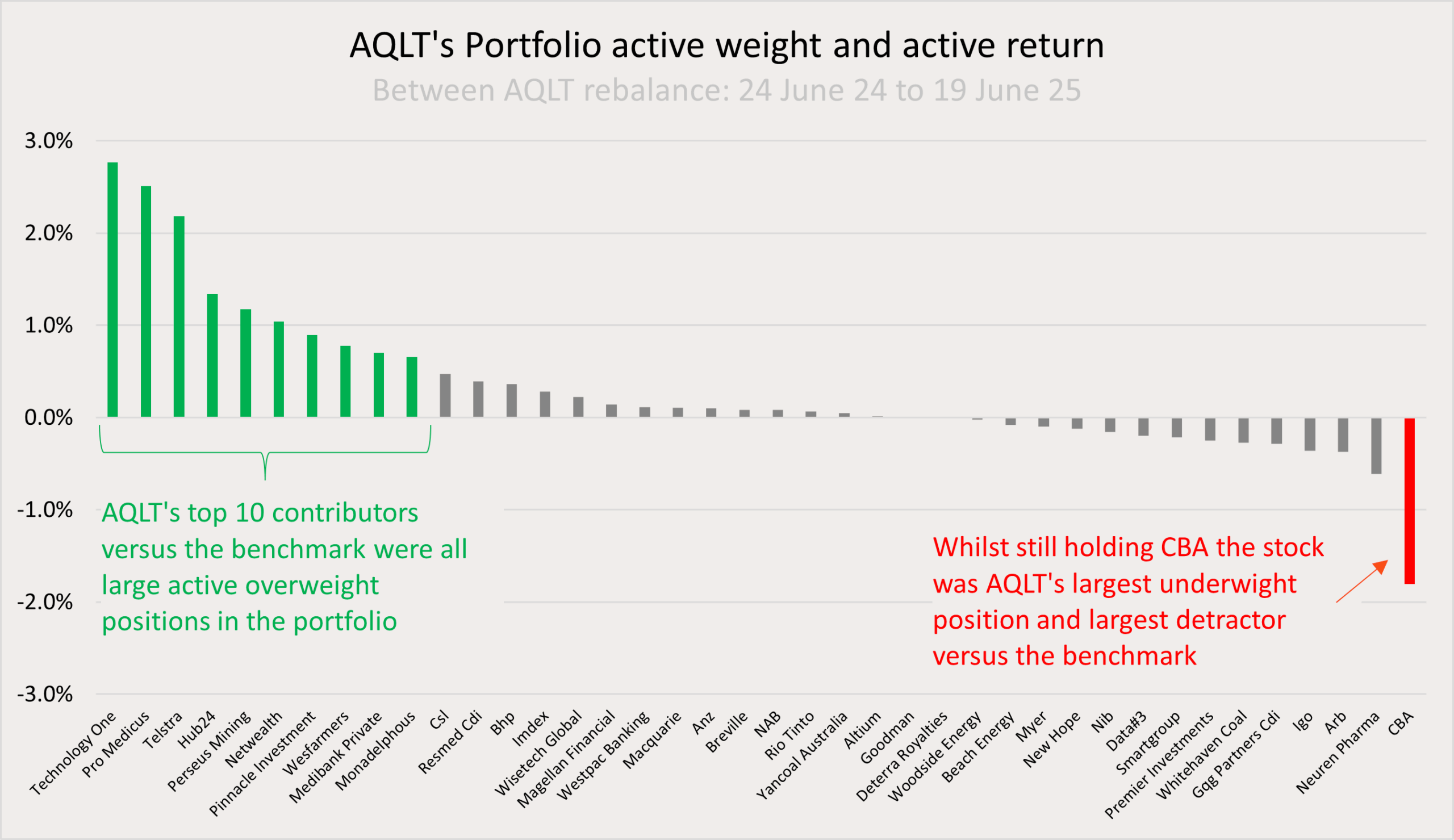

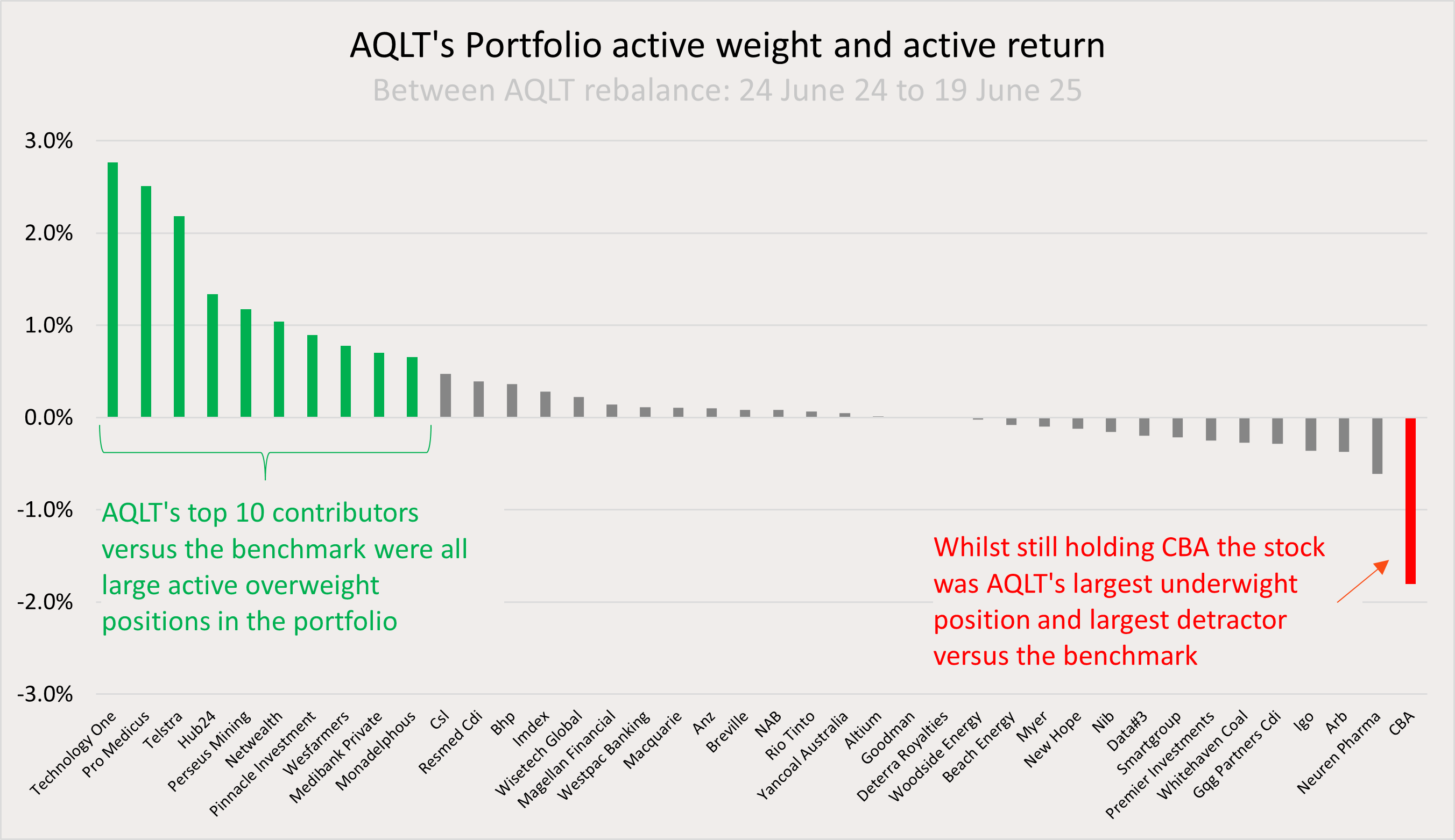

AQLT outperformed over the past 12 months due to its positively skewed distribution of active returns relative to the Australia 200 Index. Eleven of AQLT’s 40 holdings contributed to 0.5% or more of active return versus the Australia 200 Index whilst only two positions contributed to 0.5% or less; Overweight: Neuren, Underweight: CBA – more on these later.

The 10 largest contributors to AQLT’s outperformance were also 10 of the Fund’s largest overweight positions.

Put simply, AQLT’s reweighting of the largest ASX companies and selection of Australia’s high-quality mid and small caps more often than not led to stronger outperformance.

Source: Bloomberg, Betashares. Performance based on attribution data of Betashares Australian Quality ETF (AQLT) and Solactive Australia 200 Index from 24 June 2024 to 19 June 2025 and includes stocks held within AQLT during the period. There is no guarantee these stocks will remain in AQLT’s portfolio or be profitable investments. Past performance is not an indicator of future performance.

You can outperform with a CBA underweight

Over the past year CBA contributed 33% to the ASX 200’s total returns1. Much has been talked about, and blamed on, CBA for its strong run and subsequent underperformance of strategies that were underweight the stock. However, AQLT has again proved it is possible to outperform without being overweight Australia’s largest company.

Since inception AQLT has had, on average, a 3.7% underweight position to CBA (currently -6.5%) leading to 3.7% of underperformance, the largest single detractor by more than double. Despite this, AQLT has outperformed the S&P/ASX 200 by, on average, 4.2% p.a.

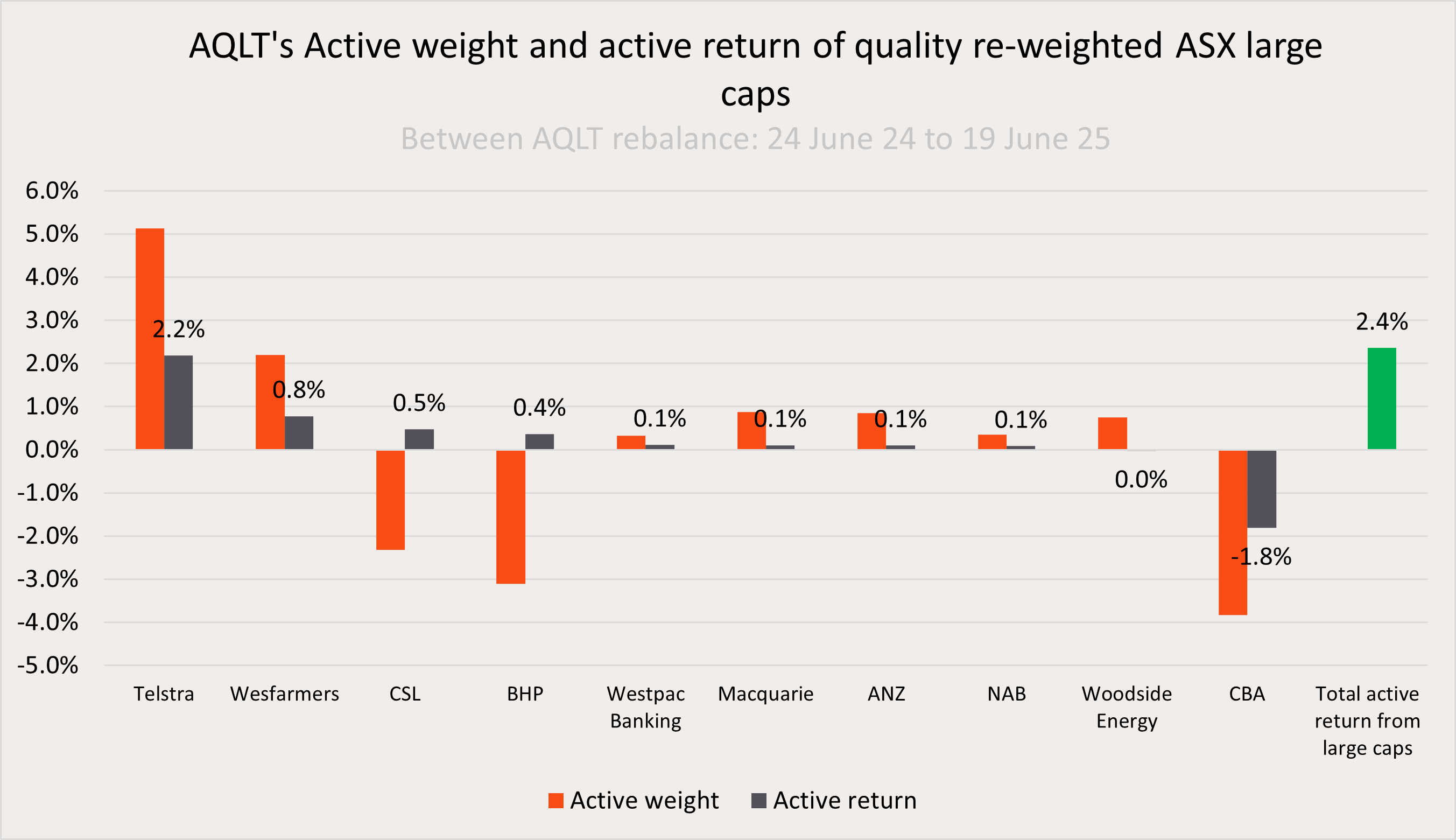

It is part of AQLT’s methodology to maintain an exposure to the largest companies on the ASX. This is done to create a large cap ballast helping the portfolio resemble a core allocation to Australian equities. However, in doing so AQLT re-weights Australia’s largest companies to reflect their relative quality metrics rather than weighting them by size alone – as is done in the benchmark index.

Promisingly, over the past year AQLT’s large cap re-weighting only led to one material detractor versus the index, CBA, and overall led to 2.4% of active returns. This highlights the ability of a considered approach to investing in Australia’s large caps to outperform the market – even when others criticise the benchmark as unfair.

Source: Bloomberg, Betashares. Performance based on attribution data of Betashares Australian Quality ETF (AQLT) and Solactive Australia 200 Index from 24 June 2024 to 19 June 2025 and includes stocks held within AQLT during the period. There is no guarantee these stocks will remain in AQLT’s portfolio or be profitable investments. Past performance is not an indicator of future performance.

Picking the best and avoiding the worst

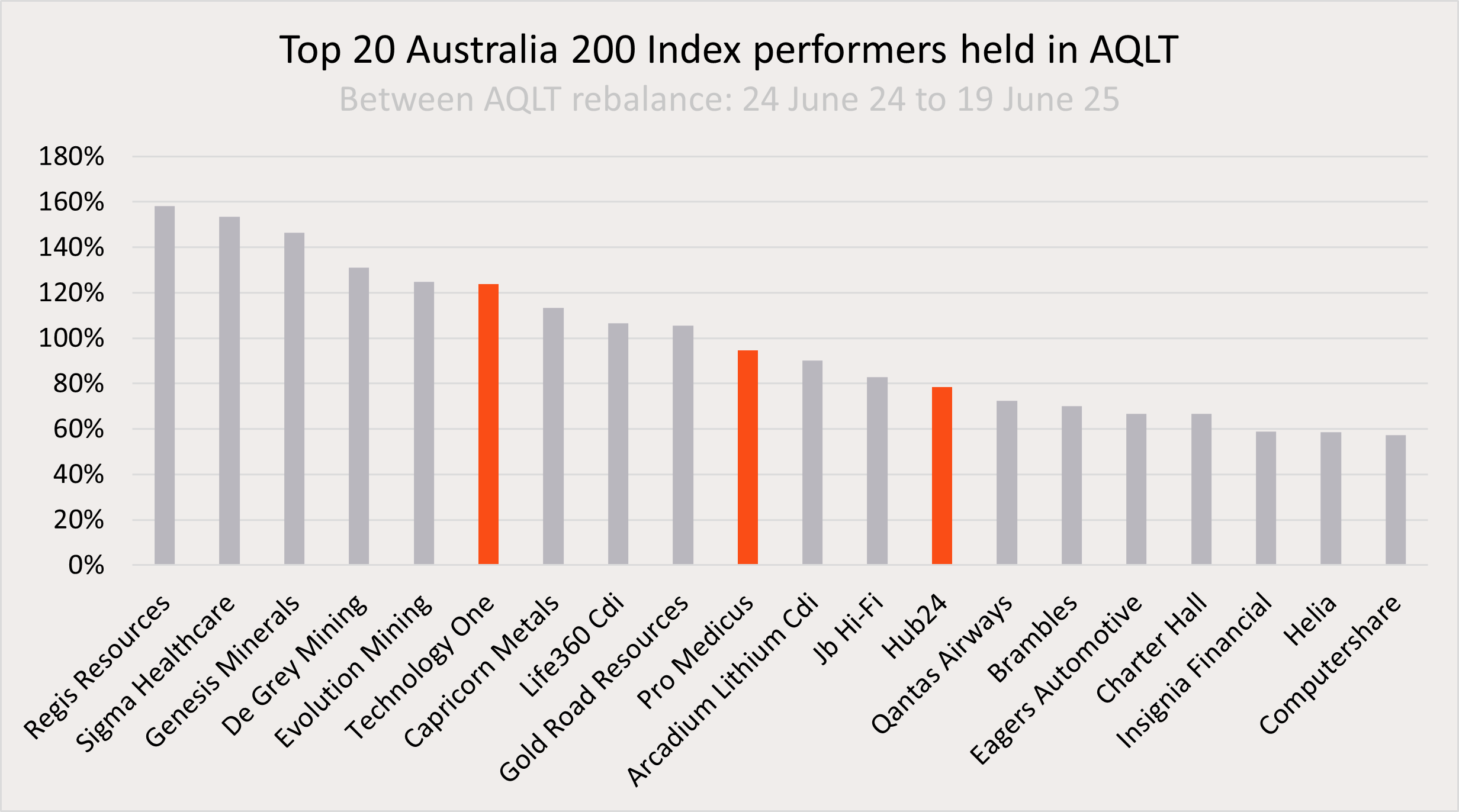

Quality screens won’t necessarily always pick the top performers. Sometimes the top-performing stocks are driven by speculative price gains, cyclical factors, or unexpected windfalls that were not already factored in expected earnings.

For example, this year six of the top 10 performers on the ASX were gold mining companies, which due to their cyclical nature are not often ranked as high quality.

Promisingly, AQLT held two of the remaining four top ten performers (Technology One, and Pro Medicus). AQLT held three of the 20 best performing companies in total.

Source: Bloomberg, Betashares. Performance based on attribution data of Solactive Australia 200 Index from 24 June 2024 to 19 June 2025 and includes stocks held within the Solactive Australia 200 Index during the period. There is no guarantee these stocks will remain in AQLT’s portfolio or be profitable investments. Past performance is not an indicator of future performance.

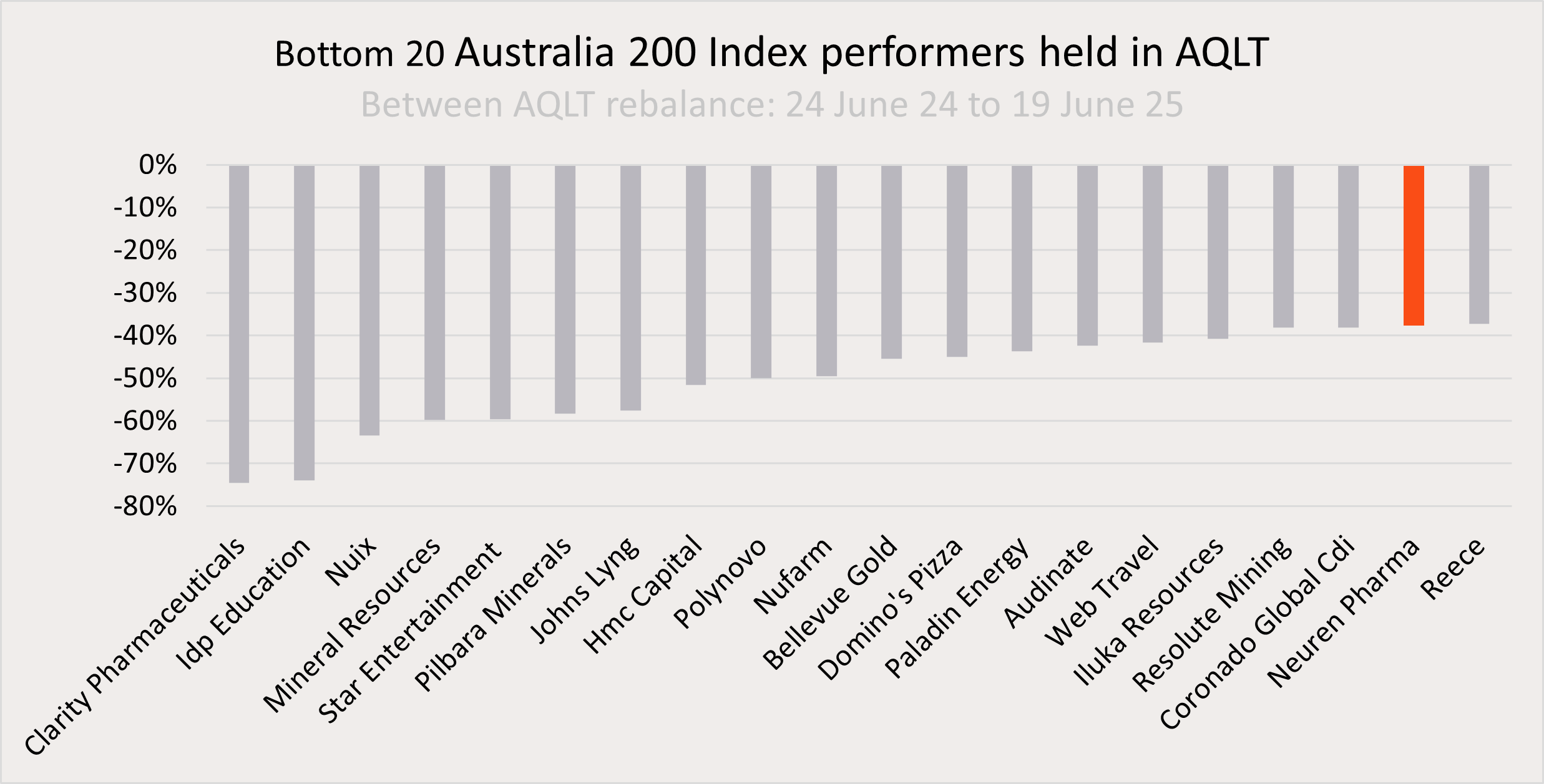

AQLT also picked up one of the 20 worst performers on the ASX this year, Neuren Pharmaceuticals.

Neuren, a market darling in years prior, was the subject of an activist investor report attempting to undermine bullish analyst recommendations and forecasts around its signature drug, Daybue. However, sentiment has recently improved once again with the second leg of Daybue’s strategy underway and as Neuren move toward commercialising a second drug.

With strong ROE and low levels of debt, Neuren remained in AQLT’s portfolio following the most recent reconstitution and has rebounded 18% since (as at 4 July 2025).

Source: Bloomberg, Betashares. Performance based on attribution data of Solactive Australia 200 Index from 24 June 2024 to 19 June 2025 and includes stocks held within the Solactive Australia 200 Index during the period. There is no guarantee these stocks will remain in AQLT’s portfolio or be profitable investments. Past performance is not an indicator of future performance.

In summary

AQLT’s outperformance versus the ASX 200 benchmark this year was driven by both its reweighting of Australia’s large caps to reflect their relative quality metrics as well as its selection of the highest quality mid and small caps on the ASX. Whilst not picking up a large portion of the top performers on the ASX, AQLT’s portfolio still achieved meaningful outperformance.

In what has been a challenging asset class for investors, AQLT offers a unique solution to investors with exposure across 40 Australian large, mid and small caps screened for their quality attributes. AQLT has grown to over $500m in FUM since its inception in April 2022 and performed in the top 1% of peer funds in Australia over that time2.

AQLT can be used in a diversified portfolio as a core Australian equities allocation. Alongside existing low-cost passive Australian ETFs, AQLT can improve portfolio diversification and fundamentals. AQLT may also be suitable as a replacement for higher cost active managers.

For more information please visit AQLT’s fund page here.

Resources:

1. Source: Bloomberg. As at 30 June 2025. ↑2. Source: Morningstar Direct. As at 30 June 2025. Includes all funds categorised in Morningstar’s Australia Australia Large Blend, Growth and Value categories. ↑