If you’d like to listen to this week’s Bass Bites, click on the player below:

Global week in review

Global stocks edged lower last week as concerns around US President Trump’s tariff strategy returned.

Tariffs are back

Global equities tried hard last week to ignore the flurry of tariff announcements from US President Donald Trump. Trump announced a 50% tariff on copper and Brazil, 35% on Canada and threatened 30% tariffs on Europe and Mexico.

Most of these are still “threatened” tariff levels that will apply on 1 August if satisfactory trade deals are not finalised. But at best, it now seems that the minimum tariff countries will face will be around 15-20% and not the 10% universal tariff that has applied since Trump postponed his 2 April “liberation day” tariffs.

Markets are still hoping deals will be struck and lower tariffs will eventually be put in place. But countries are mulling their options – strike back, strike a deal or do nothing to test if Trump is bluffing?

After all, it should not be forgotten that large tariffs on major trading partners are a tax on US consumers and business. We are yet to see the price impacts but they are likely coming.

If all countries face large tariffs, moreover, they are less likely to lose competitiveness against other countries exporting to the US. Meanwhile, with the US close to full employment and few expecting large tariffs to last much longer under Trump, it’s hard to expect much import replacement to take place either.

Therefore, the key issue returns: will the tariffs be large enough to tip the US economy into recession? And if this does start to become a serious risk, will Trump eventually chicken out? With ultimate tariff levels still to be determined and Trump’s form in pulling back, the worst-case scenario is still not yet my base case.

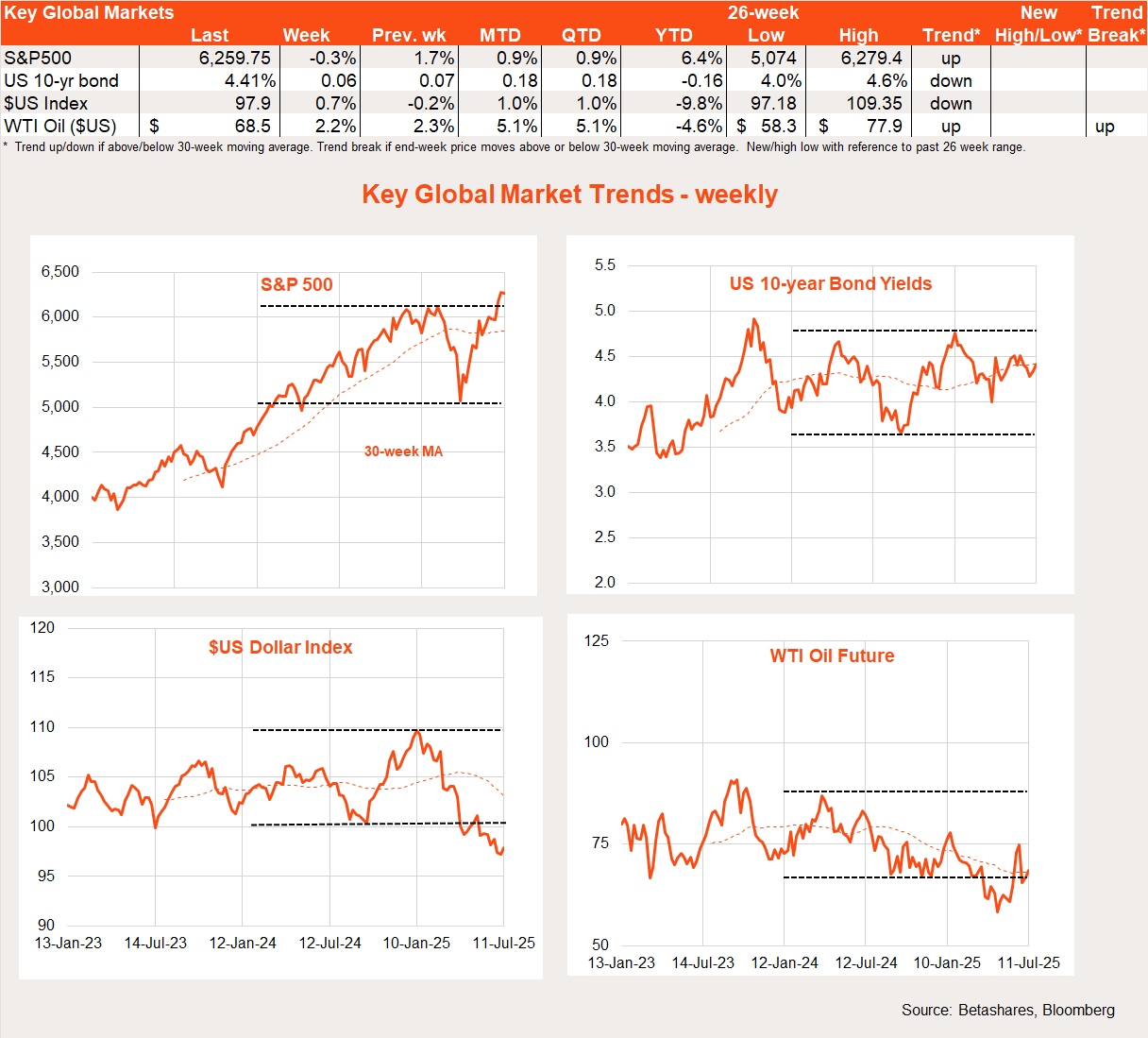

Global market trends

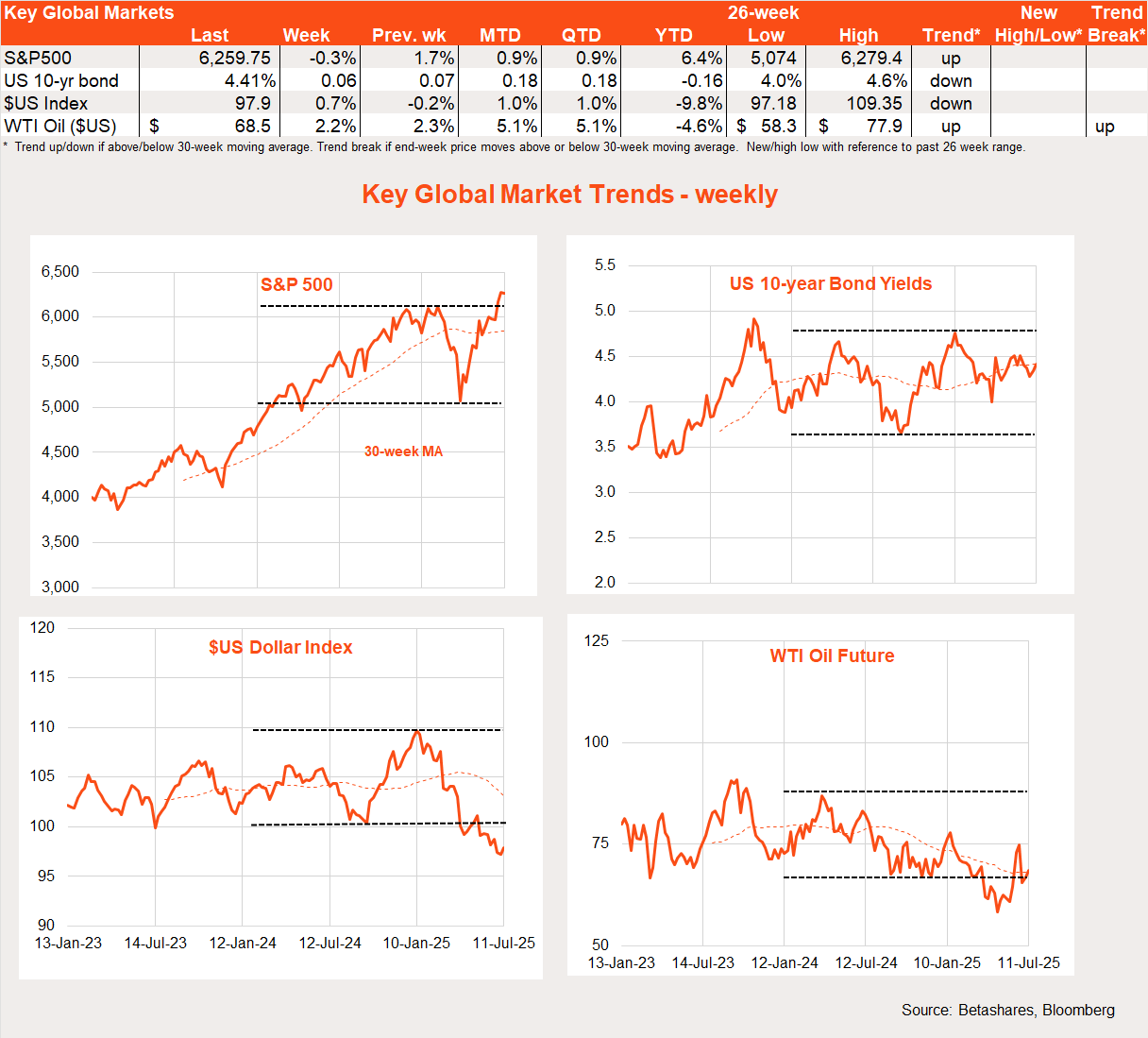

It was a mixed performance across global equity markets last week, with emerging markets and Europe holding up better than the US and Japan.

All up, however, the main trend of note over recent weeks has been the rebound in US/growth/technology relative performance, in line with the market bounce back since early April. Despite the risk-on tone over this period, small caps have refused to outperform so far.

Global week ahead: US inflation test

While markets will keep careful watch over tariff developments, we also get a smattering of important US economic data this week – along with the start of the Q2 earnings reporting season.

With modest tariffs taking effect last month, the June consumer price index (CPI) report due out tonight is expected to show a bit more of a rise than seen so far this year. Core prices are expected to rise 0.3% after a 0.1% gain in May. Markets seem to be bracing for some tariff effect to come through soon, though the magnitude and persistence of the inflation shock remains unclear.

Important clues as to tariff effects will also come via the producer and import price indices due out this week. That said, the consensus expects a modest 0.3% and 0.2% monthly gain in each respectively.

US retail sales, industrial production and consumer sentiment round out the key US economic data this week. Markets may get a little concerned if retail sales show further signs of softening.

In China, the monthly “data dump” covering retail sales, business investment and industrial production is out today. We also get Q2 Chinese GDP, which is expected to show the economy is neither too hot or cold. A 1% quarterly gain is anticipated.

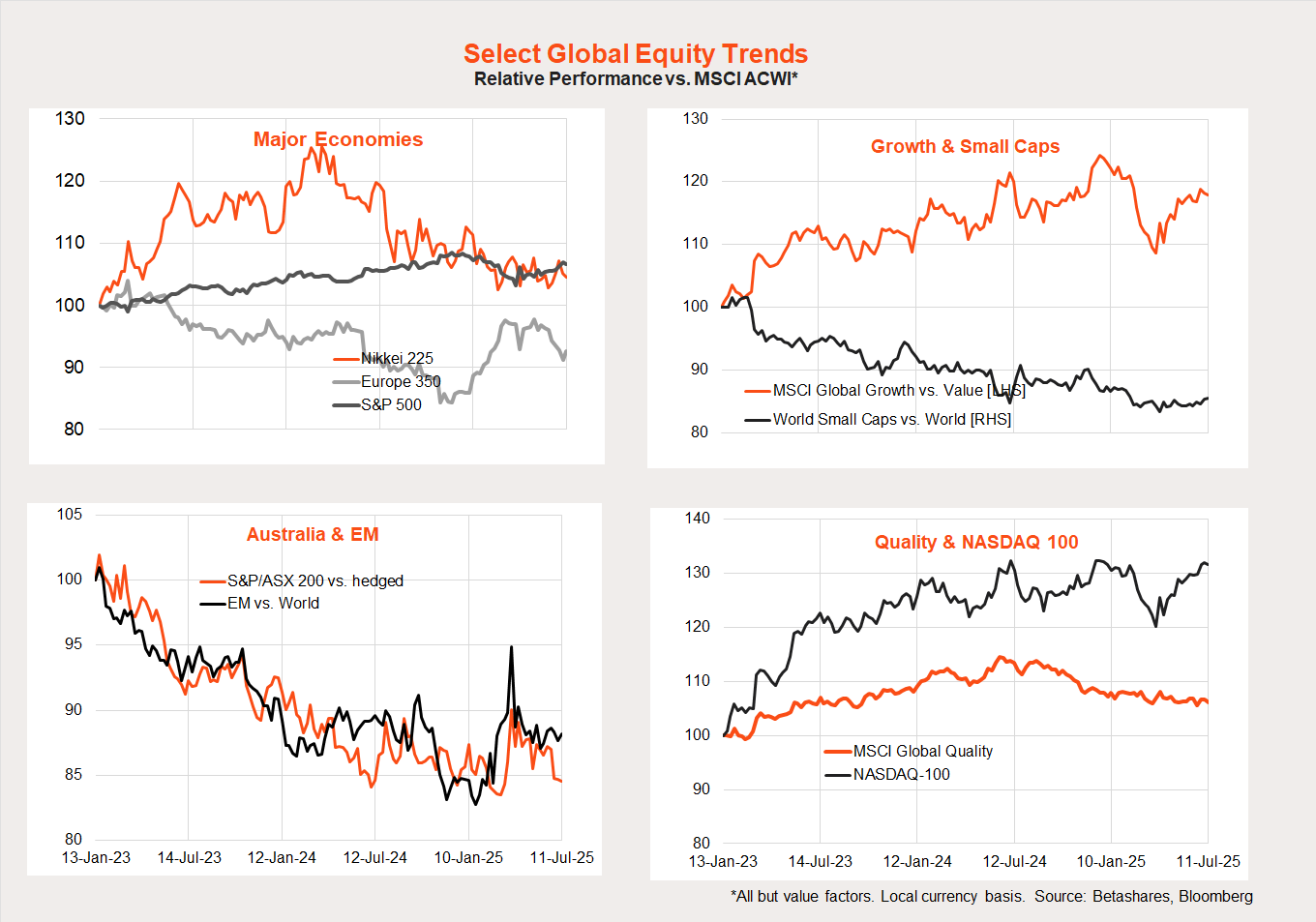

Australian week in review

Local stocks pulled back in line with global markets last week. Investors were disappointed by the Reserve Bank’s decision not to cut interest rates.

As I suggested last week, the RBA did ultimately refrain from cutting interest rates – and exactly for the reason I expected. Namely, given the volatility found in the monthly CPI reports, the RBA would wait for confirmation of a further reduction in underlying inflation in the Q2 CPI due next week. It’s a case of a rate cut delayed, not denied. I fully anticipate a good CPI next week and a rate cut in August.

Also of note, RBA Governor Michele Bullock indicated that markets can no longer rely on signalling from the Bank (via speeches or media leaks) if market expectations of RBA action begin to diverge meaningfully – as was the case last week. After all, to do so would undermine the authority of the newly restructured RBA Board, which now has a few fiercely independent members who won’t take kindly to reading in the paper what they are supposed to decide a week ahead of schedule!

My sense is the failure of the RBA to signal that market expectations were wrong (or at least overly optimistic) is why many economists jumped on the rate cut bandwagon last week. It was not due to weakness in retail sales or tariff uncertainty, as some have claimed.

The bottom line is all economists – myself included – must continue to keep careful watch of the data and form our own opinions as to what the Bank may or may not do.

As I’ve been repeatedly reminded last week – you are only as good as your last call!

Australian week ahead: A still firm labour market

Support for the case that the RBA does not need to rush to cut interest rates should be found in this Thursday’s labour market report. After a surprise drop in employment during May – which followed a surprise surge in April – a more normal 20k gain in employment is expected this week, which should be enough to keep the unemployment rate steady at 4.1%.

Despite the still-solid labour market, consumer spending remains the major drag on economic growth. Although there’s been some recovery in consumer sentiment over the past year, it remains below average – and the return of tariff uncertainty and the RBA’s failure to cut rates last week could see sentiment dip back a little in tomorrow’s report.